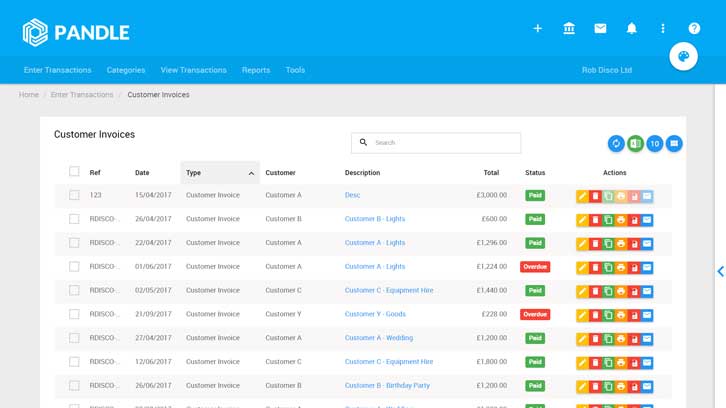

A business’s financial transactions are tracked and reported via accounting software.

Accounting software’s fundamental components include billing, bookkeeping, and accounts payable and receivable.

Debt collection, expenses, timesheets, purchase reconciliation, payroll, and reporting for all of these may be non-core accounting software modules.

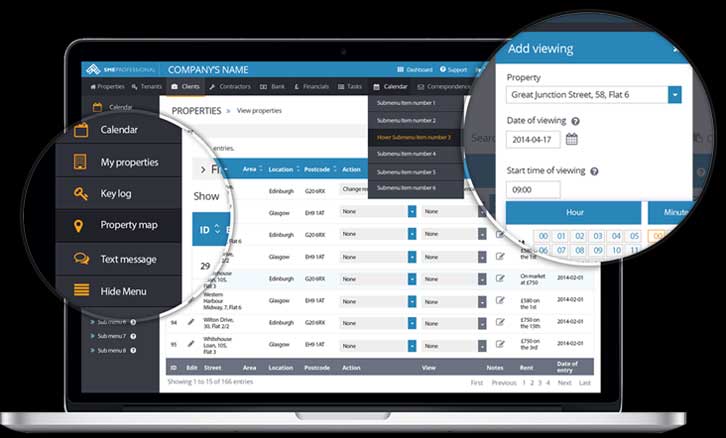

Either desktop-based or cloud-based accounting software is available. Here is a list of the top cloud-based small company accounting programs.

Here are our top choices of accounting software examples:

Oracle NetSuite Accounting Software

For small business owners who wish to receive a thorough image of their company while automating some accounting processes, Oracle’s NetSuite is an excellent option.

NetSuite is our choice for the best accounting software with enterprise resource planning (ERP) solutions because it allows you to manage every area of your organization from a single dashboard.

The following fundamental accounting features are offered by NetSuite to help you organize and expedite your financial procedures:

- A ledger, generally

- Payables receivable

- Receipts to be made

- Tax planning

- Management of fixed assets

- Managing money

- Handling of payments

Zoho Books

Zoho Books is the type of straightforward accounting software that microbusinesses require.

All of the fundamental functions that microbusinesses require are provided by Zoho Books, along with more sophisticated capabilities like project billing and time tracking.

Additionally, it includes integrations, allowing you to keep utilizing the program as your company expands.

This article determined that Zoho Books was the most user-friendly and cost-effective accounting program for small enterprises.

Features of Zoho Books Accounting

- Automations

- Internet payments

- Mobile app

- Tools for project management and time tracking

GoDaddy

The lines between online and offline sales channels are becoming more hazy for small business owners who must manage both, therefore it’s critical for such companies to have an accounting tool that can keep all of those transactions together.

GoDaddy Online Bookkeeping stands out in that aspect because of its integrations with online stores like Amazon, Etsy, and PayPal, as well as how simple it is to issue invoices, take payments, and run a variety of reports.

GoDaddy Online Bookkeeping is our pick for the finest accounting program for online retailers since it offers all of those features at a competitive price.

GoDaddy offers three cost-effective pricing options.

The monthly cost of the entry-level plan is $4.99, the middle-tier plan is $9.99, and the top-tier plan is $14.99.

Melio

Complex accounting software is not necessary for all business owners.

You should give Melio significant consideration if all you need to do is send invoices and accept money.

The fact that you can handle bills, take payments, and interface with QuickBooks for free made this free accounts payable software one of our top choices.

Payments made via bank transfer with this cloud-based program are free, while credit card payments incur a 2.9% cost.

Accepting customer payments by check or bank transfer is free.

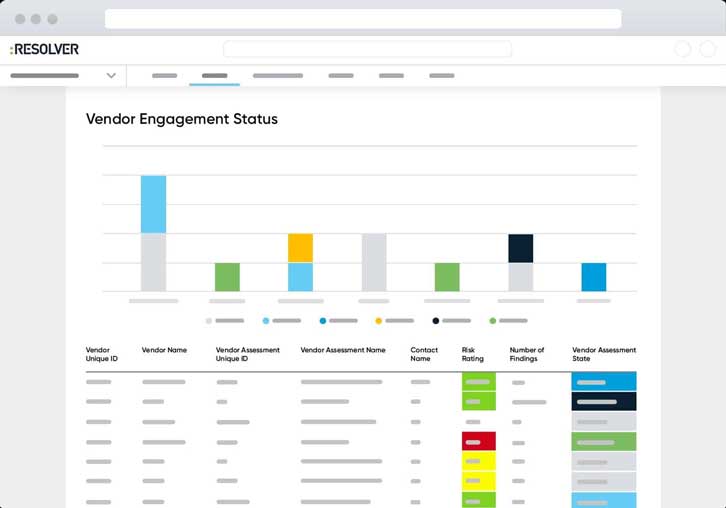

Zarmoney

There are no price-related trade-secrets with ZarMoney.

Too frequently, it’s difficult to estimate how much an accounting program will cost, making it challenging to compare prices. Contrarily, ZarMoney takes pride in being plain, and this is seen in theetized pricing schemes.

For entrepreneurs, small business owners, and businesses, ZarMoney offers straightforward pricing structures.

Unlimited transactions are supported by the entrepreneur plan, which costs $15 per month for a single user, and by the small company plan, which costs $20 per month for two users and unlimited transactions.

On those plans, an extra user costs $10 per month. The monthly fee for ZarMoney for large businesses with more than 30 users is $350. Customer support is offered for all plans in the US.

Plooto

The majority of small businesses are time-constrained, therefore everything that can be automated is appreciated.

This article chose Plooto as the finest accounting software for automating accounts payable procedures since it offers small businesses a lot of that at a reasonable cost.

Small businesses who want to improve their accounts payable and accounts receivable while saving money might choose Plooto.

wIt distinguishes itself from other accounting software by automation and interfaces with QuickBooks and Xero, making it a perfect option for business owners that use those accounting programs.

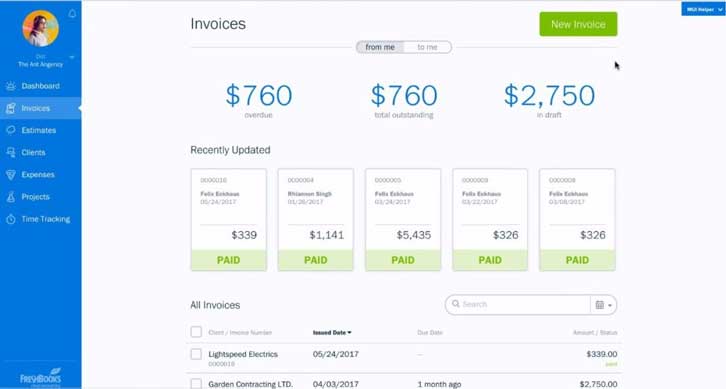

QuickBooks

What is QuickBooks unable to do? Small firms everywhere employ the incredibly well-liked accounting software.

Accountants are quick to laud the application for its effectiveness, price, and use.

Given the requirements of small businesses today, it is difficult to discover many issues with QuickBooks.

QuickBooks Online provides small business owners with an affordable, feature-rich accounting software that can be integrated with a ton of other business tools.

To complete the sales cycle, many firms find it useful to link their accounting software with their credit card processing service provider. This article appreciate that the software is cloud-based and is frequently updated.

Conclusion

Accounting software keeps track of many accounting variables and records transactions.

The software can be configured to automatically pull financial data from your bank, or you can utilize a very basic version that would require manually entering the information.

We advise you to track your company’s finances using software that automatically downloads financial data from your bank and credit card provider.

Additionally, the majority of software solutions save the data in the cloud, so even if your computer fails or you run into other technical difficulties, your data will be secure and safe.